I’m dedicating this week’s roundup to the large number of regulatory actions in crypto this past week. These movements could be decisive for the future of Web3 so I think they are worth following closely. Last week I shared Nic Carter’s wrap up on “Operation Chock Point 2.0”. This past week has proven to be an equally wild rollercoaster, including Kraken receiving a $30M fine from the SEC and Paxos being ordered to stop minting BUSD.

Here are some of the articles from last week that best describe the various twists and turns.

SEC proposes rules that would change which crypto firms can custody customer assets (CNBC)

SEC chair Gary Gensler proposed amending federal custody requirements, expanding the rules to include assets like crypto, a change that would require crypto exchanges to gain further regulatory approval. The proposed changes would mandate custodians, including crypto exchanges, secure or maintain certain federal or state registrations, even as regulators are both increasing scrutiny on crypto companies and making it more difficult to secure regulatory approval for crypto products.

Congressman French Hill has been appointed as the chairperson of the House Subcommittee on Digital Assets, Financial Technology, and Inclusion, charged with setting rules for cryptocurrency after a year of high-profile failures and plunging prices. His mission will start with stablecoins - digital dollars built on blockchains that have opened up a Pandora’s Box of regulatory questions such as whether they should be considered securities. A draft bill proposed last year would ban their issuance unless created by an approved subsidiary of an insured institution or by a licensed non-bank entity.

Crypto is joining the grown-up table, and no one is happy about it (CNN)

Following the bankruptcy of FTX in November, regulators have increased their scrutiny of the crypto industry and are embracing a Dodd-Frank-style approach to regulation. When FTX collapsed in November, many called it the “Lehman moment.” The comparison holds true in broad strokes: An industry giant came tumbling down, contagion spread, and regulators who’d been reluctant to act suddenly had a clearer target and a wave of public outrage to bolster their cause. And now, we may be officially entering the Dodd-Frank era of crypto. (Dodd-Frank, of course, being the 2010 legislation Congress passed in response to lax oversight in parts of the banking industry that plunged the world into one of the worst financial crises in history.)

Kraken to Shut US Crypto-Staking Service, Pay $30M Fine in SEC Settlement (Coindesk)

Crypto exchange Kraken will “immediately” end its crypto staking-as-a-service platform for U.S. customers and pay $30 million to settle Securities and Exchange Commission (SEC) charges it offered unregistered securities, the U.S. agency announced Thursday.

SEC to Sue Crypto Trust Co. Paxos Over Binance Stablecoin: WSJ (WSJ via Coindesk)

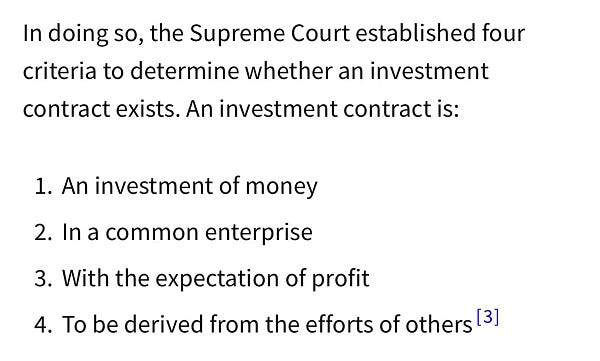

The U.S. Securities and Exchange Commission (SEC) intends to sue stablecoin issuer Paxos, which is behind the Pax dollar (USDP) and Binance USD (BUSD) tokens, over the latter stablecoin, the Wall Street Journal reported Sunday.

Paxos plans to “engage with the SEC staff on this issue and are prepared to vigorously litigate if necessary.” The crypto community is baffled over this lawsuit; as CoinTelegraph put it, “Members of the community were confused and argued that people buying the stablecoin were not expecting it to go up in value.”

I wish Gary Gensler would just go away!

Heyy, just came accross your newsletter and I think its awesome. I also run a web3 news substack for underrepresented creators called Facesofweb3. Would you be open to a recommendation exchange? Our subscribers need to be able to find each other!

Great job, once again!